Bitcoin, whiskey, or Hermès: The rise of passion investments

- Investing in Bitcoin offers the potential for substantial rewards, but it also involves significant risks due to its inherent volatility.

. - Passion investments like rare whiskey, fine art, luxury items, and cars are considered stable compared to Bitcoin, with the potential for high returns.

. - Industry experts and passion-investment enthusiasts comment on these alternative investment options, their value, and associated risks.

. - Find out why Lego has become one of the best-performing passion-investment assets.

.

- Plus: While commodities such as gold are often lauded as a safe haven for investments, they can be volatile and costly to store.

. - Interested in investing in Bitcoin, NFTs, and other passion investments from the comfort of your home? Do so safely by using a VPN for PC, Mac, smartphones, tablets, or routers.

In the fast-paced and ever-evolving landscape of investments, two intriguing options have emerged as interesting alternatives: Bitcoin and passion investments. While Bitcoin’s decentralized nature and limited supply have garnered significant attention, its volatile journey has left investors questioning its stability.

At the same time, passion investments, encompassing digital assets like NFTs and tangible items like rare whiskey, fine art, and even Lego, have surged in popularity, outperforming traditional assets like gold and stocks.

To better understand the intricacies of Bitcoin and passion investments, we explore their unique characteristics and provide insights into navigating their unpredictable nature.

Get ready to put your money where your passion is!

Disclaimer: The information presented in this article is for informational purposes only and should not be construed as financial advice. Investing in Bitcoin or passion investments involves risks, and individuals should conduct their own research and consult with a qualified financial advisor before making any investment decisions. The author and the platform do not assume any responsibility or liability for the accuracy, completeness, or timeliness of the information provided herein. Investment decisions should be based on individual circumstances and risk tolerance.

Jump to…

Bitcoin’s turbulent journey

Risky business: Investing in Bitcoin

The attractive returns of passion investments

Mad about whiskey

Picture-perfect profits

Ride to riches: Cashing in on cars

Bagging the profits

The building economy: Investing in Lego

Going for gold

8 Ways to stay safe when buying assets online

Bitcoin's turbulent journey

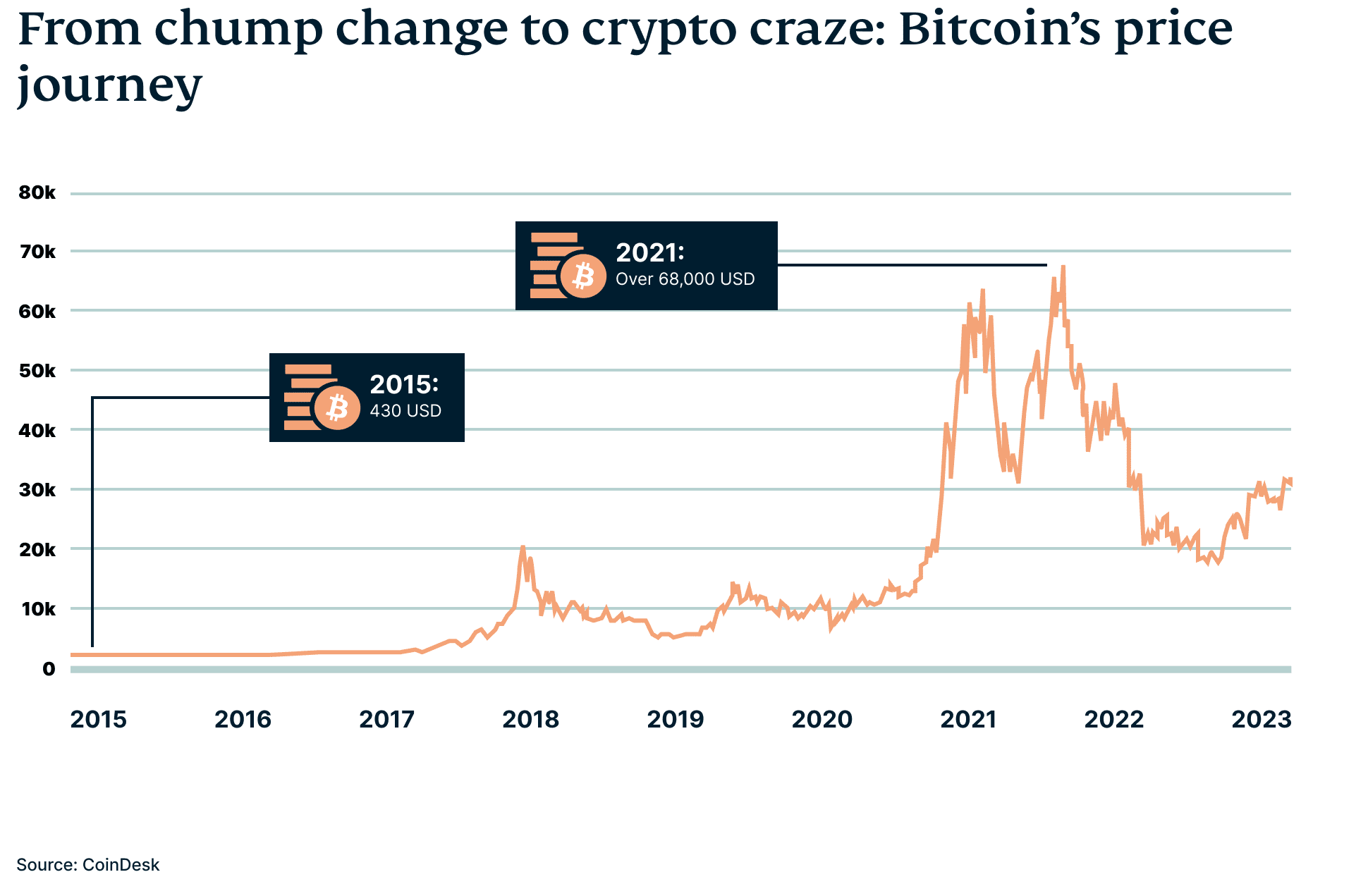

Bitcoin, the groundbreaking cryptocurrency that emerged in 2009, has undergone a remarkable ascent from obscurity to global recognition. Its decentralized nature and increasing acceptance have fuelled intrigue worldwide. However, the cryptocurrency market’s rollercoaster ride has been anything but smooth.

The dramatic rise and subsequent crash of Bitcoin's value in 2022, commonly called the "crypto winter,” has left many investors cautious. The crypto winter has also significantly impacted the cryptocurrency exchanges, with major players like Core Scientific laying off employees and selling off assets.

While some analysts believe that the market has bottomed out and that the next bull market is on the horizon, others believe that the crypto winter is not over yet and that Bitcoin could fall even further.

This type of volatility and the struggles of major exchanges raise questions about the long-term stability of Bitcoin and its viability as a reliable investment option—a sentiment echoed by many American investors.

A survey conducted by CNBC: Make It, in collaboration with Momentive, an AI company, revealed that about 60% of Americans considered investing in cryptocurrencies highly risky, with an additional 26% regarding it as moderately risky.

However, despite this perception of risk, Bitcoin continues to shine due to several factors:

- Bitcoin has achieved widespread recognition and adoption, with major companies integrating it into their operations, signaling mainstream acceptance.

- Its limited supply of only 21 million coins creates scarcity, which, coupled with increasing demand, drives potential long-term price appreciation.

- Institutional interest in Bitcoin, as evidenced by the involvement of renowned financial institutions, adds legitimacy and attracts both retail and institutional investors.

- The decentralized nature of Bitcoin appeals to those seeking alternatives to traditional financial systems, and the evolving regulatory landscape, while posing short-term challenges, can foster long-term stability.

With these factors in play, Bitcoin undoubtedly presents an alluring investment opportunity. However, there are lingering concerns about its stability.

Bitcoin's questionable stability

Prominent financial influencers such as Kevin O'Leary of Shark Tank, Jim Cramer, and Tony Robbins have likened Bitcoin to the thrill of gambling in Las Vegas. Despite acknowledging the risks involved, some investors are drawn to the excitement and potential of Bitcoin’s constant price fluctuations.

In June of this year, according to data from CoinMarketCap, Bitcoin reached a value just above 30,000 USD—the highest point since its 2022 crash. This bounce-back showcases the resilience of Bitcoin in overcoming challenging periods. However, it also highlights the inherent volatility of the cryptocurrency.

Jackie Tan, head of product at Tribe, a Web3 and blockchain ecosystem company, stresses the importance of caution when approaching Bitcoin investments. He tells ExpressVPN, “The value of cryptocurrencies can fluctuate wildly, unlike traditional stocks. While good decisions and bets can lead to high returns, you can wake up to the complete opposite the next day.”

Tan further notes that regulatory uncertainties contribute to the relative risk associated with Bitcoin investments. “Any changes in government regulations can impact the legality and viability of this asset, further contributing to its risky nature,” he says.

Global events, cultural shifts, community sentiment, social media trends, and even celebrity endorsements all have a significant influence on the value of Bitcoin. These factors can create hype and increased demand for specific coins. Tan points out that the growing interest from institutional investors, hedge funds, and companies has played a crucial role in legitimizing cryptocurrencies as investment assets and driving up demand.

For those seeking an alternate investment option to Bitcoin, passion investments may be a compelling option.

The attractive returns of passion investments

Passion investments, encompassing digital assets and tangible treasures like NFTs, rare whiskey, fine art, and luxury items, have gained traction for their unique appeal and impressive growth. In fact, these alternative assets outperform mainstream investments like gold and equities, offering more stability.

A significant advantage of most passion investments is the ability to physically possess and enjoy them while retaining their value. Unlike virtual assets, they provide a tangible connection that resonates with investors’ personal interests.

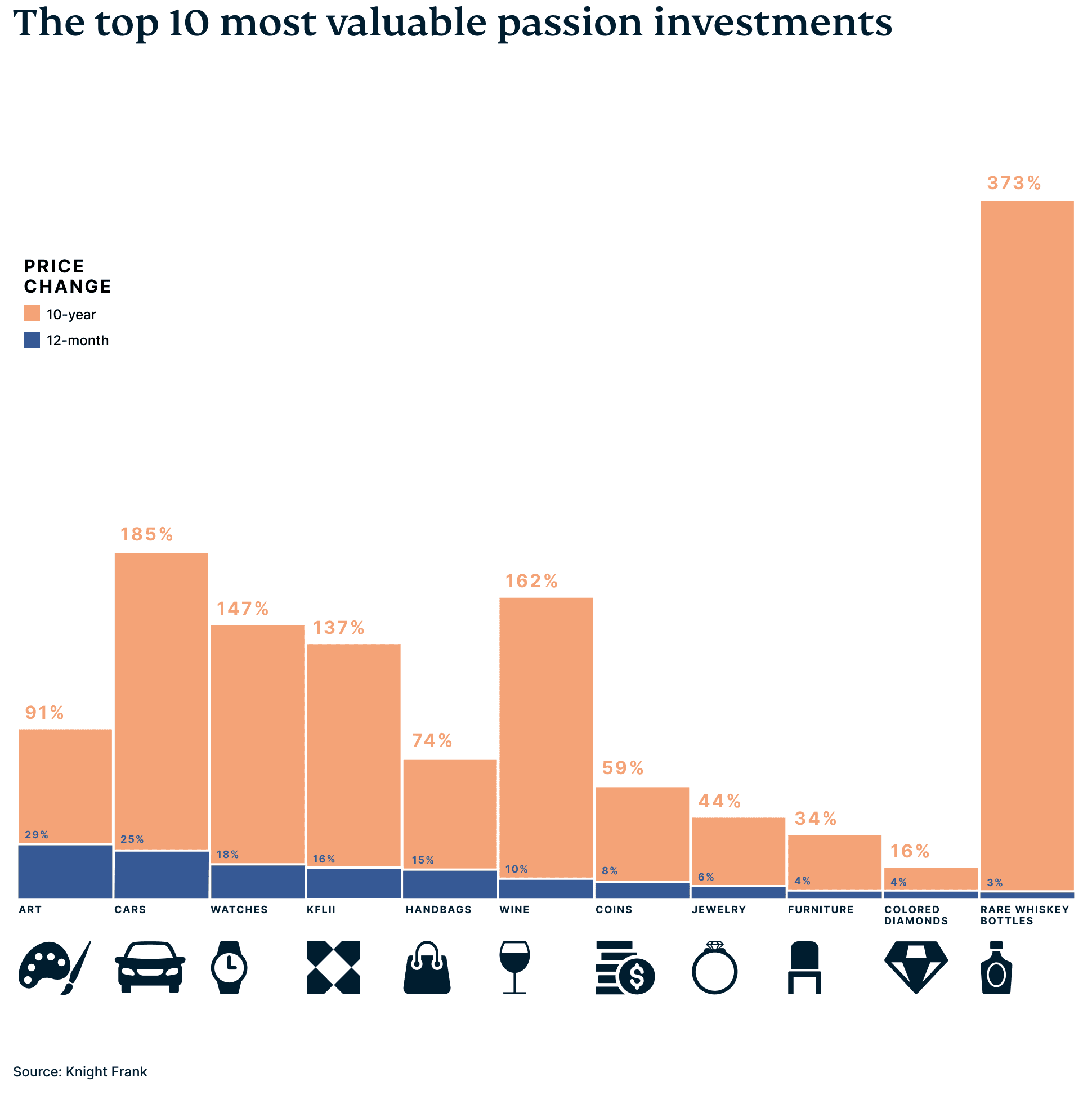

The popularity of passion investments is also evident in their impressive performance. For example, the Knight Frank Luxury Investment Index (KFLII) reported a 16% surge in this investment category in 2022 (as detailed in the graph below), surpassing traditional assets. This attracts further exploration of the potential benefits and risks of passion investments—especially in contrast to Bitcoin’s volatility.

Mad about whiskey

When it comes to passion investment classes, according to Knight Frank’s (KFLII) 2022 Wealth Report, rare whiskey is the clear leader, boasting a growth rate of 373% over 10 years. Interestingly, several factors come into play when determining the value of whiskey, including its age, rarity, and overall quality.

James Phang, the founder of Singapore Liquid Gold Club and LiquidGoldAuctioneer, explains, “Compared with traditional financial instruments, whiskies will always have an inherent value as a consumable. The worst that can happen is that if your whiskey investment performs badly, you can always drink it.”

Phang, who has been investing in whiskey since 2015, believes the prized liquid will remain a prominent alternative investment. He explains, “Whiskey will continue to be a mainstay in alternative investments because every rare bottle opened is one bottle less in the world. And when we drill down to single cask bottles, the outturn is much lower, which makes these bottles scarcer.”

Notable success stories in the whiskey market support Phang's belief. For instance, he highlights the case of The Macallan Distillery. “In 2022, it made headlines when a 'forgotten' cask from 1988, bought for 5,000 GBP, sold for more than 1 million GBP at an auction.”

“The worst that can happen is that if your whiskey investment performs badly, you can always drink it.”

Regarding the impact of online auction platforms, Phang states, “The availability of online auction platforms, both in the UK and in Asia, has also provided people with channels to purchase rare whiskies with little barriers of entry, with simple processes in place to ensure a hassle-free user experience, thereby driving up demand significantly."

However, it’s necessary to exert caution when entering the whiskey investment market. Earlier this year, The Guardian reported instances of scammers deceiving young whiskey investors in the UK through social media, selling nonexistent whiskey casks—the lack of regulation in the industry creates an environment where inexperienced investors can be easily misled.

Experts advise that verifying the authenticity and existence of a whiskey investment can be challenging without proper documentation, such as a certificate of ownership, deed of title, or a signed document acknowledged by a warehouse. Furthermore, it’s worth considering the potential return on investment as it’s a niche market and some bottles might not sell or perform as expected.

Picture-perfect profits

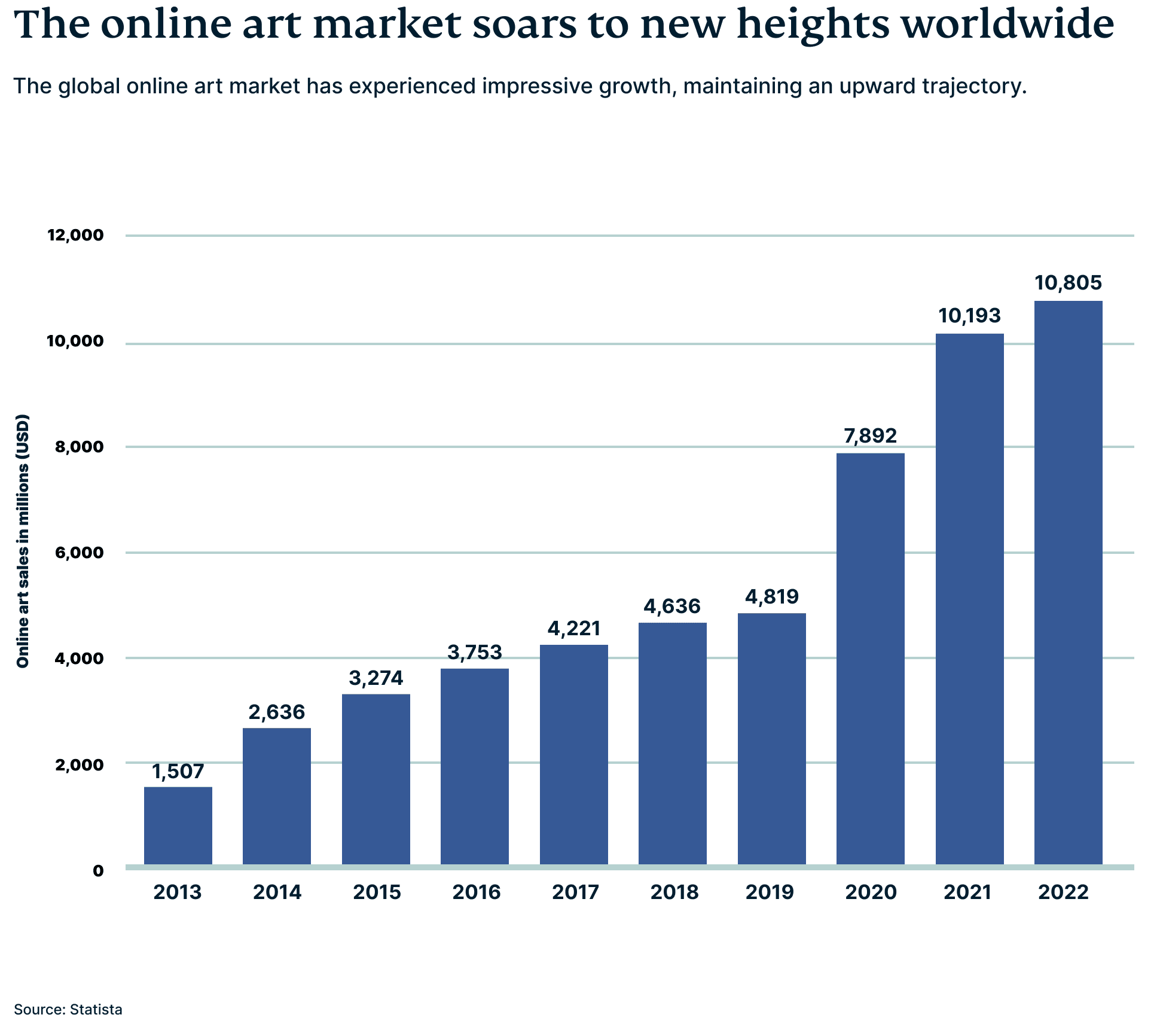

Investing in fine art can potentially be a profitable way to diversify a portfolio and generate high returns. In 2022 alone, fine art outperformed other passion investment asset classes, boasting an impressive surge of 29%. The sale of fine art also generated a staggering 10.8 billion USD in value through online sales.

In a 2022 survey conducted by Statista, it was revealed that 74% of global art buyers utilized Instagram as a platform to discover fresh art-related talent. This finding is further corroborated by Artsy, an online marketplace, in their report on art industry trends. According to Artsy’s survey, a significant number of galleries identified Instagram as a crucial channel for discovering new artists, with interactions between artists playing a pivotal role. The report also revealed that online sales were key revenue sources for their galleries in 2022.

Unlike stocks and bonds, the value of fine art doesn't directly correlate with the stock market, making it a potential hedge against market volatility. Additionally, investing in fine art allows you to derive aesthetic enjoyment while pursuing your financial goals, particularly if you have a passion for art.

However, it's important to note that fine art is typically more challenging to sell, rendering it a relatively illiquid asset. This could pose a problem if you require quick access to cash. Artsy also highlighted in its report that inflation has prompted galleries to increase the prices of their artworks, further complicating the selling process.

Moreover, similar to whiskey, the costs of purchasing, storing, and insuring fine art can be substantial. Art storage facilities, which often necessitate climate-controlled environments, can diminish your returns and hinder profit generation from your investment.

Furthermore, some experts, such as the Institute of International Finance, anticipate a contraction in the art market this year due to inflation and economic downturns in Europe.

What about NFTs?

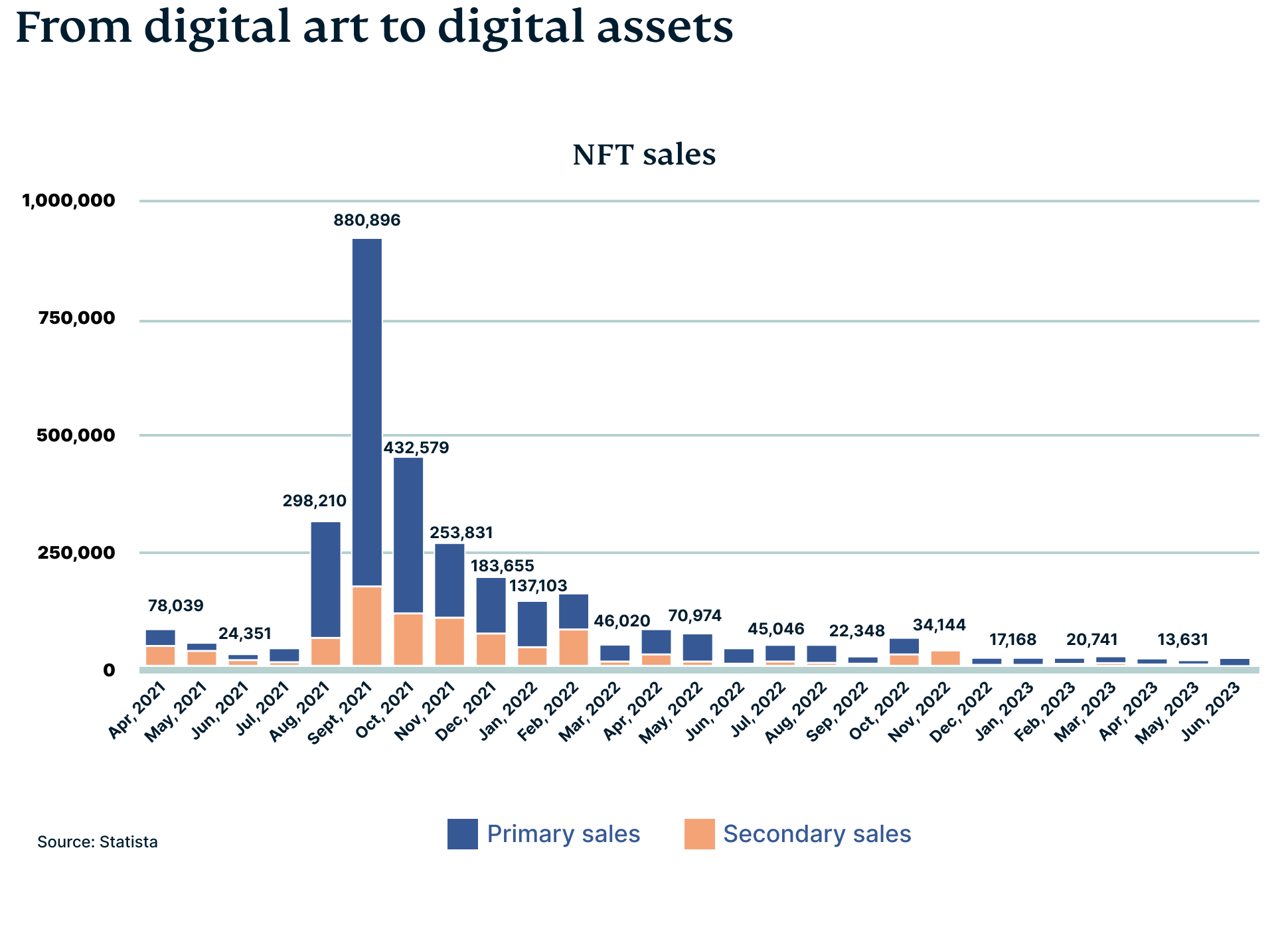

After experiencing a meteoric rise in popularity throughout 2021, fueled by celebrity endorsements and fervent online communities, the NFT market has undergone a substantial cooling-off period since 2022. Since its peak in January 2022, NFT trading volume has plummeted more than 97%. At the peak of its success, NFTs commanded prices in the millions of dollars. For example, the NFT artwork “Merge” by digital artist Pak fetched a staggering 91.8 million USD on the NFT platform Nifty Gateway, establishing itself as one of the most expensive NFTs ever sold.

Several factors have contributed to the decline of the NFT market. One significant factor is the waning of the initial hype surrounding NFTs, leading many individuals to adopt a more skeptical stance toward the technology. The graph below illustrates the downward trajectory of NFT sales from April 2021 to June 2023.

Low-quality NFTs have also flooded the market, which has made it difficult for buyers to discover high-quality offerings. The fluctuating cryptocurrency market has also adversely affected the value of NFTs. As cryptocurrency prices have dwindled, so has the value of these one-of-a-kind digital assets.

However, despite the decline in the market, a few positive indicators persist. The blockchain and augmented reality (AR) technology underpinning NFTs remains nascent, leaving room for future growth and development. Moreover, notable NFT projects like Women and Weapons and fashion NFTs from brands like Louis Vuitton have achieved success in recent months, indicating that interest in the technology endures.

Ride to riches: Cashing in on cars

Similar to fine art, luxury cars possess a distinct allure, characterized by their exclusivity, rarity, craftsmanship, and status as a symbol of, well, status. These qualities grant them a unique advantage over the unpredictable fluctuations of the stock market, making them an important asset for hedging against inflation.

For example, the sale of a 1962 Ferrari 250 GTO in 2018 surpassed a staggering 60 million USD, while a 1955 Mercedes-Benz 300 SLR Uhlenhaut Coupe (pictured below) fetched 143 million USD in 2022. Both cars are considered some of the most expensive automobiles sold at an auction. For some, cars are considered an essential asset because they can be sold for large amounts, especially when needed.

However, investing in luxury cars can carry potential drawbacks:

- The steep initial purchase price can represent a significant outlay of capital.

- Luxury cars are also known for their high maintenance and repair costs due to their unique, high-end components.

- Like most vehicles, luxury cars depreciate quickly, often losing half their value within the first five years, according to one go-to car site, HotCars.

- The insurance cost is typically higher, too, adding to the total cost of ownership.

- Lastly, the market for second-hand luxury cars is quite niche, making it difficult to sell the vehicle for a good price when you choose to.

Bagging the profits

Luxury handbags, long revered as more than mere fashion accessories, have continued to captivate investors with their enduring appeal. However, in the aftermath of the pandemic, the demand for these coveted items has soared to unprecedented heights. Brands like Hermès, Chanel, and Louis Vuitton have solidified their positions as market leaders, as buyers recognize the immense value and potential returns they offer.

One noteworthy testament to the investment potential of luxury handbags occurred in 2016 when Christie's, a renowned auction house, achieved a groundbreaking sale. A rare Hermès Himalaya Birkin (pictured below), widely considered the Holy Grail of handbags, fetched a record price of over 300,000 USD.

The exclusivity of Birkin bags, in particular, has long made them notoriously difficult to acquire, even for enthusiastic buyers. Aspiring owners find themselves navigating a purchasing process so exclusive that TikTok users often document their journey to enlighten others. To secure a Birkin, one must first establish a relationship with a sales associate and meet specific spending criteria, ultimately earning a coveted spot on the brand's VIP waitlist. Subsequently, lucky individuals are notified when a bag becomes available.

JTT Wong, a devoted luxury fashion fan and seasoned investor in Hermès bags, shares an insider’s perspective with ExpressVPN, stating, “Even while on the waitlist, I’m willing to pay a premium to expedite the process. In fact, whenever I encounter a sales associate willing to sell a bag at any location, regardless of the model or my personal preference, I seize the opportunity immediately. Duty-free locations like the Frankfurt or Tokyo airports have proven especially fruitful.”

Wong tells us about a recent successful transaction involving a pink mini Hermès Lindy with palladium hardware, saying, “I bought it for approximately 7,000 USD and later sold it for around 14,000 USD within a week.”

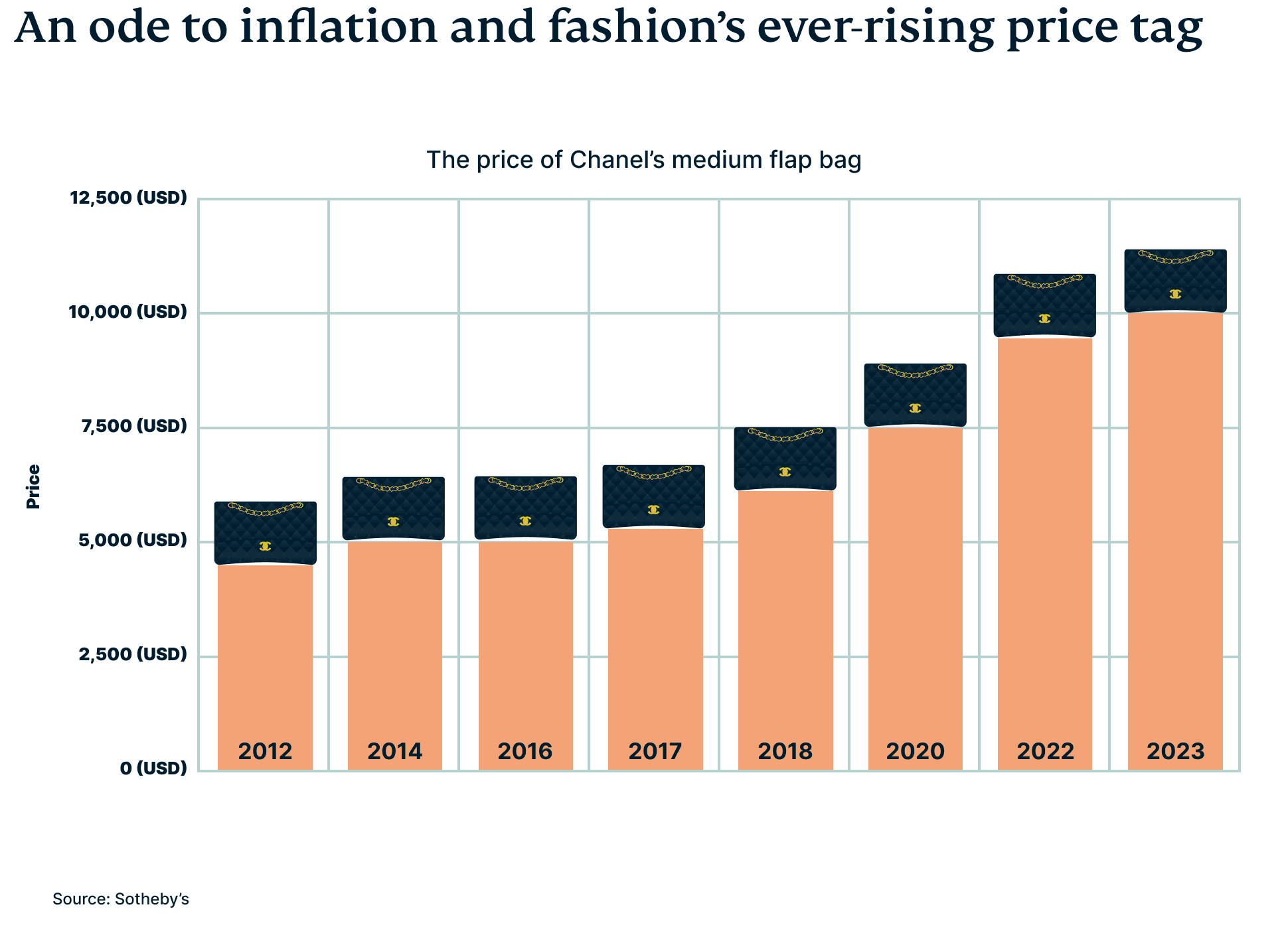

Chanel bags have also witnessed a significant increase in price over the years, with the most recent being in March this year. Sotheby’s reports that Chanel raised the price of its Medium Classic Flap bag by 16% (it now retails for over 10,000 USD). Other popular designs like the Coco Handle, Chanel 19, and Pearl Crush have also seen a price increase of 14%.

Wong offers insights into the future profitability of bag investments, explaining, “As long as Hermès and Chanel maintain their business models, investing in luxury bags will likely remain lucrative. Many traders rely on parallel trading, purchasing bags in Europe and reselling them in Asia, as a key strategy for maximizing profits.”

Like luxury bags, investing in luxury watches can be both an engaging hobby and a potentially profitable venture. For instance, a Rolex Daytona that was purchased for 200 USD in the 1960s now commands a value of about 150K USD, highlighting the possible returns in this market.

The craftsmanship, rarity, and brand reputation of high-end watches from established names like Rolex, Patek Philippe, and Audemars Piguet contribute to their ability to retain or even increase in value over time. As with Hermès bags, it’s rumored that those interested in an Audemars Piguet watch will need to prove their worth and genuine interest to a sales associate before being invited to view and purchase a timepiece from the brand.

“As long as Hermès and Chanel maintain their business models, investing in luxury bags will likely remain lucrative.”

The building economy: Investing in Lego

In a 2022 study, the Research in International Business and Finance Journal delved into the realm of financial returns and made a striking discovery—Lego not only outperformed large stocks, gold, and bonds, but surpassed them by a significant margin. The highly regarded Niche Market video series by The Wall Street Journal reported that adult fans of Lego, known as AFOLs, have been enjoying investment returns that surpass the average. One enthusiast, who The Wall Street Journal interviewed, said he sees a return rate of 150% to 250% per sale.

According to David Thorn, an AFOL and content director at ExpressVPN, “Lego has been outperforming the market in recent years as a collectible because the people who grew up with Lego are now entering their prime investment years and can afford to pay top-dollar for the sets they had, or desperately wanted to have, as kids. Having a big collection you can show off is as appealing in your 40s as when you were 8. Except now that collection can be really, really big.”

Investing in Lego sets comes with its own set of rewards and challenges. On the positive side, Lego sets have demonstrated consistent growth in value over the years, particularly those that are rare or discontinued. According to War Gamer, a gaming news site, some of the priciest Lego sets this year include the Space Command Center, valued at just over 10,000 USD, and the Lego Castle (1978 variant), valued at 9,900 USD. Many collectors and investors find joy in assembling these sets, and the nostalgia associated with the brand further adds to its value. Moreover, the global popularity of Lego provides a broad market for resale.

However, there are negatives as well. The Lego investing market can be volatile and unpredictable, with no guaranteed returns. As Thorn shares, “Of course, the big risk is that the demographic bubble feeding all this interest will burst. Gen Xers may not keep investing at this scale as they retire. And sets from newer eras, when Lego became a behemoth, won’t have the same vintage scarcity.”

The storage issue also poses a challenge, as Lego sets necessitate meticulous maintenance to preserve their value. It also often takes a considerable amount of time for sets to appreciate, and the process of selling them can be both time-consuming and complex.

“The people who grew up with Lego are now entering their prime investment years and can afford to pay top-dollar for the sets they had or desperately wanted to have as kids.”

In light of these factors, how should Lego enthusiasts approach investing?

“I’m a fan of Lego, but as an investment, it remains something of a gamble,” explains Thorn. “I recommend buying what you want to own so that if the demand one day evaporates, you have a set you might want to build with your kids. Lego lasts forever. The blocks are nearly indestructible unless really abused, left out in the sun, or hit with a hammer. So it’s fun. Beats an NFT or some wine that’s gone sour in the bottle, that’s for sure.”

Going for gold

If you’re not up for a passion investment, there’s always gold, long renowned as a safe haven during market turbulence. Gold investment offers a significant advantage: It possesses enduring intrinsic value and holds global recognition as a valuable asset.

Furthermore, gold exhibits a negative correlation with stocks, meaning when stocks fall, gold often rises, offering a compelling strategy for diversifying one’s portfolio. A notable example of high-priced gold is the 1933 Double Eagle Coin, which sold for a hefty 30 million USD at a 2021 Sotheby's auction.

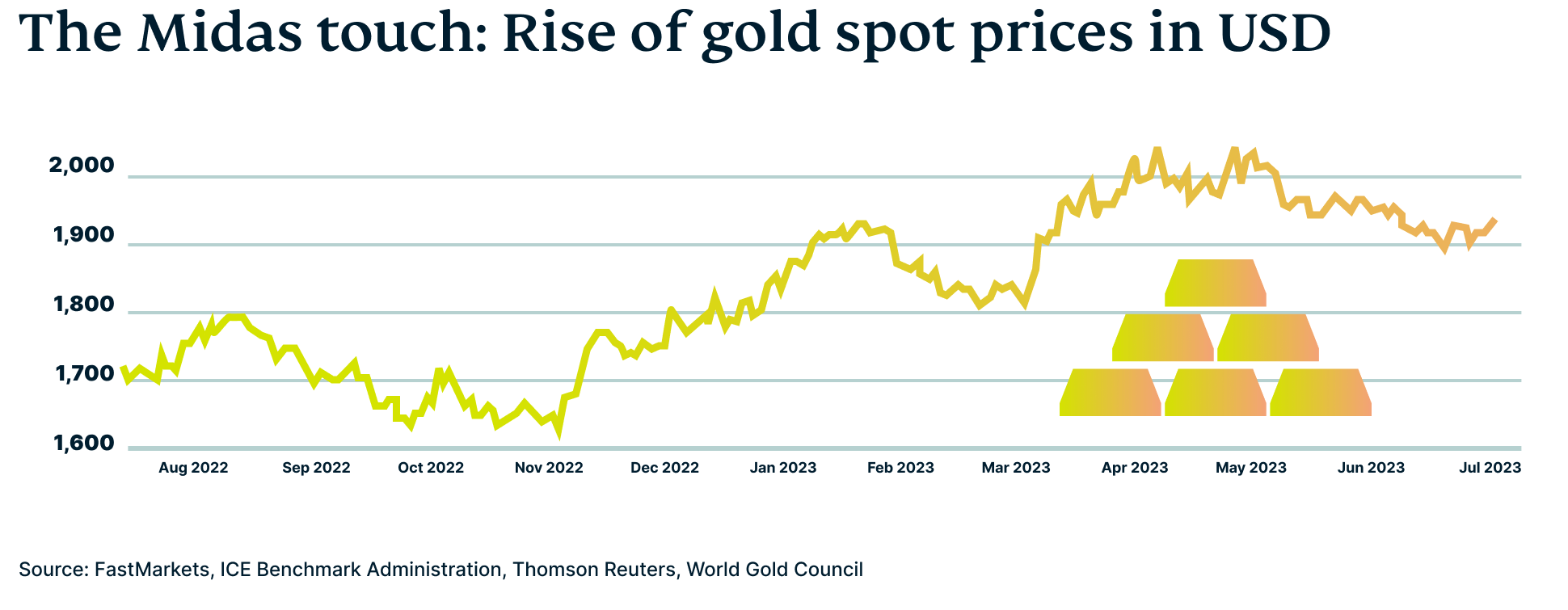

As reported by Barron’s, a financial publication, the price of gold surpassed 2,000 USD per ounce in April of this year, marking the second-highest value in history. The financial publication noted that factors such as a weaker U.S. dollar, declining bond yields, and the potential of an economic slowdown have spurred the heightened interest in gold.

However, it's important to acknowledge that gold investing does entail certain drawbacks. Gold does not generate dividends or interest, unlike stocks or bonds, rendering it a non-income-generating asset. Additionally, the price of gold can be quite volatile and unpredictable, influenced by numerous global factors—including political instability and fluctuations in currency values. Furthermore, investing in physical gold presents challenges regarding storage and insurance, which can be both problematic and costly.

8 ways to stay safe when buying assets online

Thinking about investing in Bitcoin, NFTs, gold, and other passion assets you can buy online? It's an exciting world out there, but staying safe and protecting your investments is important. Whether you're a pro or just starting out, these simple tips will help you navigate the online investment landscape with confidence:

1. Understand the technology

Before investing in digital or physical assets, take the time to understand the underlying technology and platforms for creating and trading them. For digital assets, this includes how transactions work, what smart contracts are, how wallets work, and the difference between public and private keys.

Some online auction houses charge a platform, handling, and delivery fee on physical items like art, branded bags, and cars, so your purchases are handed to you safely. As a result, it’s essential you understand how their platforms work before bidding or buying an item so you know how much you’re actually paying for something.

2. Do your homework

Diligently research any cryptocurrency, NFT, or asset you plan to invest in. For cryptocurrencies and NFTs, it’s vital that you understand the project's vision, the team behind it, its practical applications, and community support.

For other passion investments, you could read up on the value of the item you purchase. If you plan on investing in a branded bag, consider looking at online marketplaces to see which bags are in demand and how much people are willing to pay for them. Better yet, find out if you can speak to someone who’s genuinely made positive returns on a particular investment this will let give you a better lay of the land.

3. Only use trusted platforms

Use reputable exchanges and platforms for trading and storing your digital and physical assets. These platforms have robust security measures in place to protect your investments. Some cryptocurrency wallets and platforms offer insurance policies on accounts, so it might be worth looking at these policies to see if they suit your needs.

4. Keep cybersecurity practices robust

Use hardware wallets, which are physical devices that store your private keys offline, as they are more secure than online wallets. Keep your private keys offline and never share them with others. You’ll also want to implement two-factor authentication (2FA) on your accounts wherever possible, as it adds a layer of security when you log in.

When purchasing or trading physical items like fine art online, make sure you’re doing so on a trusted platform. Before signing up for an account on an online marketplace, do your research or ask about data protection measures and encryption. Some auction houses allow you to remain anonymous during the purchasing process so consider taking this option so as to not draw attention to yourself.

5. Use a VPN

A VPN won’t prevent your accounts from getting hacked, but it can encrypt your internet connection if you log into your accounts while on public Wi-Fi networks. A VPN encryption will prevent hackers and other cybercriminals from seeing your browsing history, chats with sellers, buyers, and bidders, as well as any transaction you make online.

Whether you’re using it to conduct trades through your desktop or smartphone, most reputable VPN providers, like ExpressVPN, have a VPN for PC, Mac, Android, or iPhone and more to secure all your devices.

6. Beware of scams and fraud

If you primarily buy and sell digital or physical assets online, be cautious of scams and phishing attempts as they commonly occur online through trading platforms or on social media. If you’ve received a chat request, email, or direct message from someone you don’t know, never click on any links or answer any personal questions. Also, be wary of any deals or investment opportunities that might seem too good to be true.

7. Stay informed

The world of digital and physical assets is rapidly evolving, and it can be challenging to keep up. Stay up-to-date on the latest news and updates by joining communities, and forums, and following reputable news sources such as CoinDesk for cryptocurrency news, Rebag for bags, watches, and jewelry, and Braeburn Whiskey for guidance on cask investments.

8. Seek professional advice

Cryptocurrencies and NFTs can be highly volatile, like all types of investments. If you are still deciding whether to invest in digital assets, consider seeking advice from a knowledgeable financial advisor. However, if you’re looking for some stable options, you might want to consider traditional assets like stocks and certain types of bonds.

FAQ: About Bitcoin, passion investments, and gold

Will owning one Bitcoin make you rich?

Can you make a living off Bitcoin?

Is Bitcoin safe?

Are handbags a good investment?

Is gold a good long-term investment?

Take the first step to protect yourself online. Try ExpressVPN risk-free.

Get ExpressVPN